As a small business owner, you wear a lot of hats. You’re the CEO, the marketing team, the customer service rep, and often, the bookkeeper too. With so much going on, it’s easy to let financial paperwork pile up. But here’s the problem: every minute you spend searching for a missing receipt or invoice is a minute taken away from growing your business.

If you’ve ever found yourself rummaging through emails, desk drawers, or shoeboxes full of receipts, it’s time to break the cycle. The key? Deal with financial documents the first time you receive them and embrace technology to make it effortless.

Create a Habit of Immediate Action

The biggest mistake business owners make is thinking, “I’ll deal with this later.” Later turns into next week, next month, and before you know it, tax season is here, and you’re drowning in a pile of paperwork. Instead, follow this golden rule: Handle financial documents immediately.

- Receipts? Snap a photo and upload it to a cloud-based accounting app.

- Invoices? Save them in a designated digital folder or input them into your accounting software right away.

- Bills? Pay them or schedule a payment, then archive them in a labeled folder.

Making this a habit means no more lost documents and no more last-minute panic.

Use Technology to Stay Organized

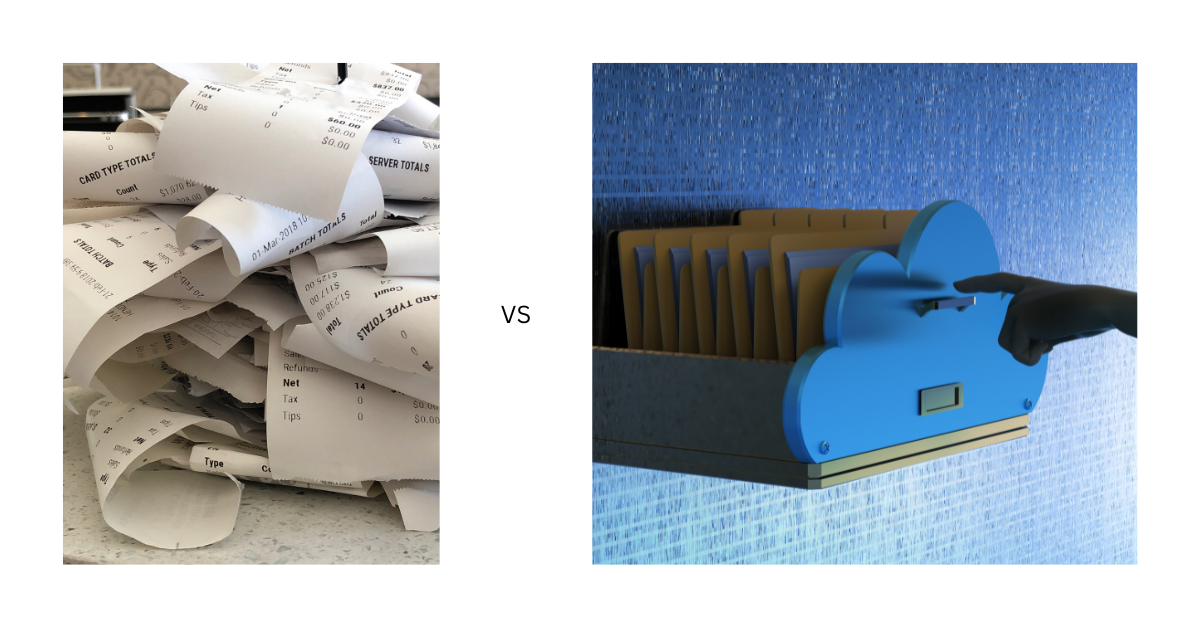

Gone are the days of manual filing and stacks of paper. With the right tools, you can digitize and streamline your financial organization:

- Cloud-Based Accounting Software: Tools like QuickBooks, Xero, or FreshBooks automatically categorize expenses and store receipts.

- Receipt-Scanning Apps: Apps like Expensify or Dext let you scan and upload receipts in real time.

- Cloud Storage Solutions: Use Google Drive or Dropbox to store invoices, contracts, and other important financial documents in labeled folders.

By leveraging technology, you eliminate the risk of lost documents, reduce stress, and save time—time that you can reinvest into your business.

Reap the Benefits of Financial Organization

When you create habits that keep your financial documents in order, you’ll:

- Reduce stress – No more scrambling at tax time.

- Save time – Spend less time searching and more time growing your business.

- Make better financial decisions – When everything is organized, you can see your cash flow clearly and plan ahead.

Final Thoughts

Running a business is hard enough without the added frustration of misplaced financial documents. The good news? A few simple habits and the right tech tools can make financial management easier than ever. So next time you receive a receipt or invoice, don’t set it aside—deal with it immediately. Your future self will thank you!

What’s one small change you can make today to get your finances more organized? Let’s start the conversation!